Greenland: The $3 Trillion Iceberg -How a Geopolitical Standoff Threatens to Reshape Global Markets

The tranquil, snow-capped landscapes of Greenland have been anything but peaceful in early 2026. What began with a seemingly outlandish proposal for a U.S. purchase has escalated into a full-blown geopolitical crisis, threatening to rupture the transatlantic alliance, ignite a devastating trade war, and send shockwaves through global financial markets. From two competing rare earth mines to the very integrity of the U.S. dollar, this icy island is now a melting pot of ambition, power plays, and unprecedented economic risk.

This isn't just a story about land; it's a high-stakes drama where $3 trillion in European-held U.S. bonds, the fate of NATO, and the future of critical mineral supplies hang in the balance. Let’s unravel the intricate threads of this unfolding crisis.

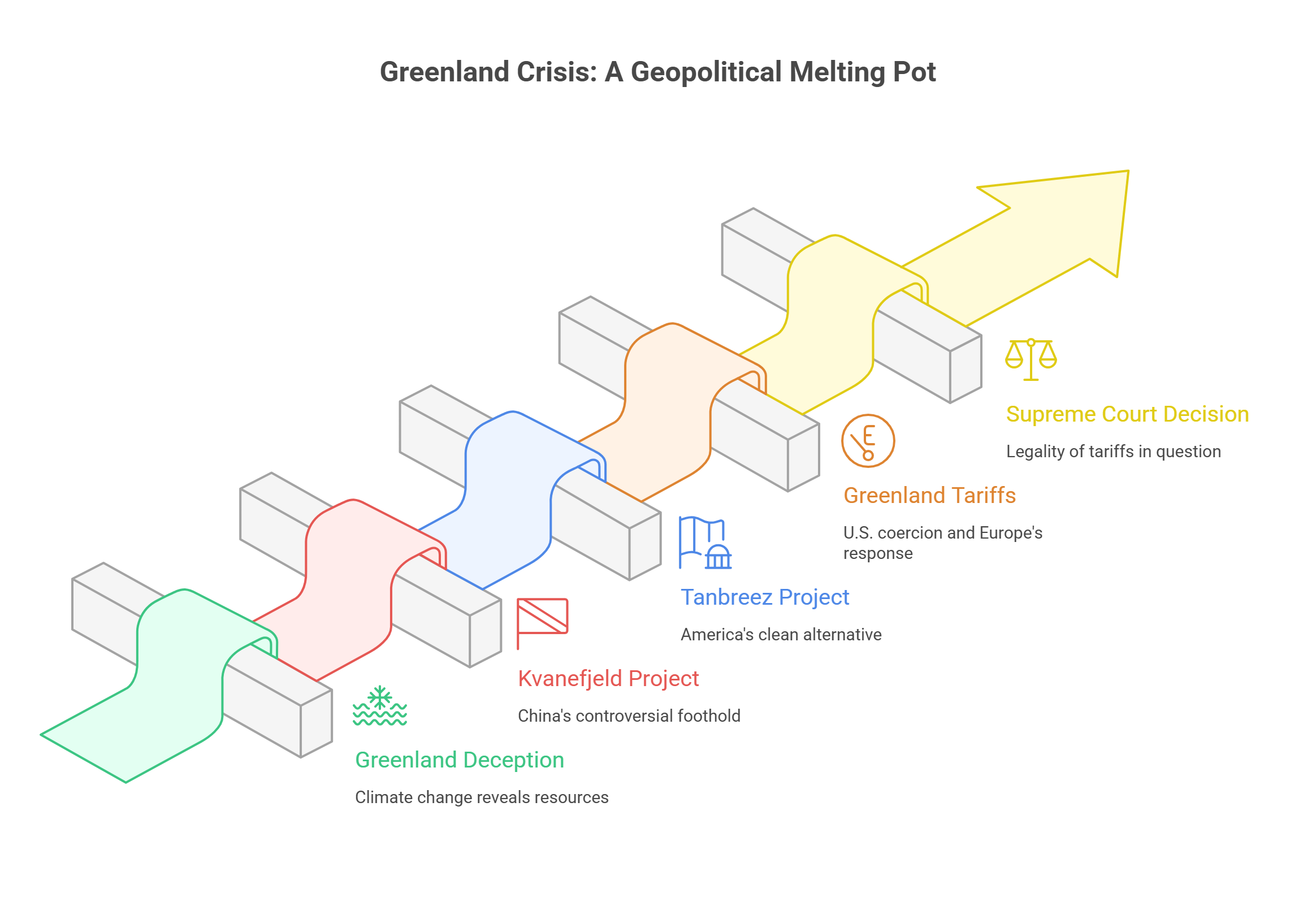

The "Green" Deception: Why Greenland is Suddenly Center Stage

For centuries, Greenland's name has been a historical marketing marvel. Coined by Erik the Red around 982 AD, the moniker "Greenland" was a clever trick to entice settlers to an island that is, in reality, over 80% covered by a two-mile-thick ice sheet. Yet, in a profound twist of irony, climate change is finally making Greenland live up to its name.

The rapid melting of Greenland's ice sheet—at a staggering rate of 30 million tons per hour—is not merely an environmental concern; it’s an economic transformation. Vast swathes of land, previously locked beneath permafrost, are emerging, revealing the island's true treasure: an estimated 10-15% of the world’s rare earth elements. These aren't just any minerals; they are the bedrock of modern technology, essential for everything from F-35 fighter jets and guided missiles to smartphones, electric vehicles, and renewable energy systems.

This "greening" of Greenland has unlocked a geopolitical chess game, with two major mining projects at its heart, symbolizing the escalating competition between global powers.

The Kvanefjeld vs. Tanbreez Showdown: A Tale of Two Mines

The current Greenland crisis is fundamentally a "mineral war", spearheaded by two rival projects:

1. Kvanefjeld: China's Controversial Foothold

At the heart of the U.S. administration's anxiety is the Kvanefjeld project in Southern Greenland. This site holds one of the world's largest rare earth deposits, but with a critical caveat: its rare earths are intricately mixed with uranium.

The primary player here is Shenghe Resources, a partially state-owned Chinese mining giant. Shenghe holds the largest stake in the company developing Kvanefjeld. For years, the project seemed poised to become a significant Chinese-backed rare earth supplier, further solidifying China's nearly 90% global monopoly on rare earth processing.

However, in 2021, the Greenlandic government, spurred by environmental and health concerns, passed a law banning uranium mining, effectively sidelong Shenghe’s ambitious plans. This led to Shenghe (via Energy Transition Minerals) launching an $11.5 billion lawsuit against Greenland and Denmark in 2025/2026 for "expropriation"—a sum that is nearly double Greenland's entire GDP.

From Washington's perspective, this lawsuit is more than just a legal dispute; it's a "Trojan Horse." The U.S. fears that China could use the immense financial pressure to force Greenland into a "debt-trap," ultimately securing control over Kvanefjeld's resources and potentially crucial Arctic infrastructure. The U.S. views this as a direct threat to its national security and technological independence.

2. Tanbreez: America's Clean Alternative

To counter Shenghe's influence, the U.S. has thrown its weight behind a rival, U.S.-backed project known as Tanbreez. Located geographically close to Kvanefjeld, Tanbreez boasts substantial heavy rare earth reserves but crucially, without the contentious uranium. This makes it a "cleaner" and politically more palatable option for both Greenland and its European allies.

The U.S. strategy is clear: ensure the rare earths from Tanbreez flow through a Western supply chain, bypassing China's processing dominance entirely. The intensifying geopolitical stakes were underscored on January 12, 2026, when the U.S. reportedly pressured Denmark to block any other southern Greenland mining sites from falling into Chinese hands, designating it a "red line" for Arctic security.

The "Greenland Tariffs": U.S. Coercion and Europe's Unprecedented Response

The mining interests quickly spiraled into a full-blown diplomatic crisis when, on January 17, 2026, the U.S. administration issued an ultimatum: either Denmark sells Greenland in a "complete and total purchase," or it faces escalating tariffs.

- The Ultimatum: Starting February 1, 2026, a 10% tariff would be imposed on goods from eight European nations (including Denmark, France, Germany, and the UK). This would jump to 25% by June 1, 2026, if no deal is reached.

This aggressive move has pushed Europe to the brink. While direct military confrontation is unthinkable between NATO allies, Europe possesses a formidable economic weapon: its vast holdings of U.S. Treasury bonds.

Europe's $3 Trillion "Financial Nuclear Option"

As of early 2026, European nations and entities hold approximately $3 trillion in U.S. Treasury securities. Major holders include the UK (~$888.5 Billion), Belgium (~$411 Billion – home to Euroclear), Luxembourg (~$410.9 Billion – a key financial hub), France (~$360.6 Billion), and Ireland (~$339.9 Billion). The combined holdings of the EU and UK make Europe the single largest foreign "bloc" investing in U.S. debt.

If Europe were to launch a coordinated sell-off of these bonds in response to the U.S. tariffs, the consequences would be catastrophic:

- Surge in U.S. Interest Rates: A mass sell-off would plummet bond prices, causing U.S. Treasury yields (interest rates) to spike. This would drastically increase the cost of borrowing for the U.S. government, potentially triggering a fiscal crisis and driving up mortgage rates and credit card interest for American consumers.

- The "Sell America" Trade: A deliberate move by European central banks and major funds to divest from U.S. assets would signal a deep loss of trust in the U.S. financial system. This capital flight would weaken the U.S. dollar significantly.

- Currency War: While a weaker dollar might seem beneficial for European exports, a rapid, politically motivated devaluation would spark a dangerous currency war, hurting global trade and exacerbating economic instability.

- Self-Inflicted Losses: Europe's own pension funds and banks would incur massive losses by selling bonds in a panicked market, making this a double-edged sword.

Denmark, bolstered by its European allies, has deployed a 200-strong "tripwire force" to Greenland—a symbolic gesture designed not to repel an invasion, but to ensure that any U.S. military action would involve firing on NATO allies, triggering Article 5 and an undeniable international crisis. Europe is also pursuing a new NATO "Arctic Sentry" mission, aiming to demonstrate its capacity to secure Greenland without U.S. annexation.

The Supreme Court's Imminent Decision: The Legal Wildcard

Adding another layer of uncertainty, the U.S. Supreme Court is expected to deliver a landmark ruling by January 23, 2026, on a case that will directly determine the legality of the Greenland tariffs. The Court is reviewing the International Emergency Economic Powers Act (IEEPA)—the very law the President cites for his tariff authority.

- The Core Question: Does IEEPA grant the President the power to impose tariffs in the name of a "national emergency," or is that power reserved solely for Congress?

- The Conservative Split: While the Court has a 6-3 conservative majority, the outcome is not guaranteed. "Textualist" judges like Neil Gorsuch and Clarence Thomas might rule against the President if the law's text does not explicitly grant tariff authority. Chief Justice John Roberts, known for his institutionalist leanings, might also side with the liberal wing to avoid a radical ruling that could destabilize global markets and the Court's reputation.

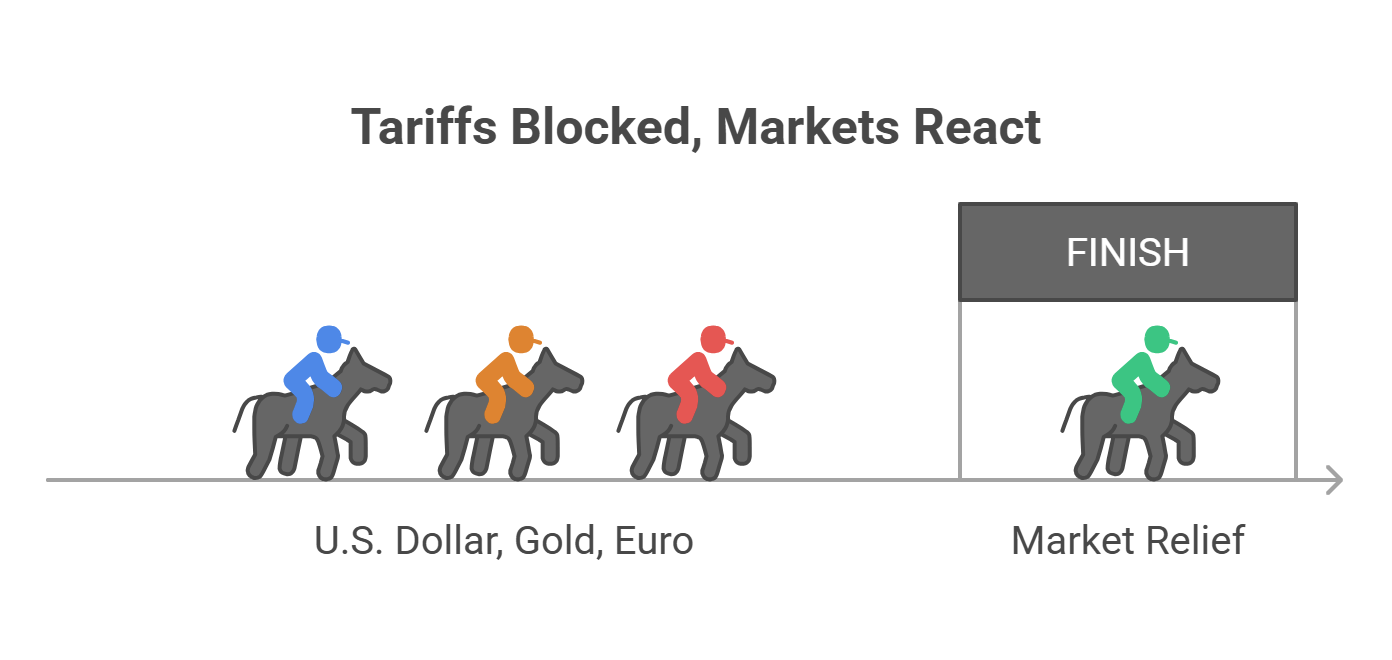

Potential SCOTUS Outcomes and Market Reactions:

- Court Rules Against the President (e.g., 5-4 or 6-3 against):

- Tariffs Blocked: The Greenland tariffs would likely be declared unconstitutional.

- Market Relief (Short-Term): The immediate threat of a U.S.-Europe trade war would recede.

- U.S. Dollar: Could strengthen slightly as the perceived "weaponization" risk diminishes.

- Gold: Might see a temporary dip from record highs as safe-haven demand eases.

- Stocks: A likely relief rally, especially for globally exposed companies.

- Euro: Could weaken slightly as the pressure on the U.S. dollar lessens.

- Greenland Crisis: Shifts back to diplomacy, but the U.S. retains its strategic interest.

- Court Rules In Favor of the President (e.g., 6-3 or 5-4 for):

- Tariffs Implemented: The 10% tariffs would likely proceed on February 1st, escalating to 25% in June.

- Market Panic: This is the "Sell America" scenario that analysts fear most.

- U.S. Dollar: Expected to weaken significantly. International investors, seeing the dollar used as a political weapon, would accelerate capital flight, driving down its value. The Euro, despite facing tariffs, could strengthen as an alternative.

- Gold: Surges to new record highs beyond its current $4,750/oz, as investors flock to the ultimate safe haven.

- U.S. Interest Rates: Would likely spike as Europe begins to sell its U.S. bond holdings, creating massive selling pressure.

- Stocks: A severe downturn is anticipated, especially for companies with global supply chains.

- Greenland Crisis: Escalates dramatically, with Europe almost certainly activating its Anti-Coercion Instrument (retaliatory tariffs) and potentially initiating a partial bond sell-off.

The Final Gambit: Plan B and the "Tripwire" Outcome

As we move toward the February 1st deadline, the focus has shifted from the ice of Nuuk to the mahogany benches of the U.S. Supreme Court. While the administration has staked its Greenland strategy on the broad use of the International Emergency Economic Powers Act (IEEPA), the legal community and financial markets are sensing a shift in the winds.

The "70% Probability" Reality

As of today, January 21, 2026, prediction markets like Polymarket have stabilized at a 70% probability that the Supreme Court will strike down the administration’s use of IEEPA for broad tariffs. This isn't just a legal opinion; it’s a massive financial signal. If the Court rules "No," the primary weapon the U.S. is using to pressure Denmark—the 25% tariff threat—effectively evaporates overnight.

What Happens at the 6-3 "No" Vote?

If the Court rules 6-3 against the administration, expect a "market snapback":

- The "Gold Correction": Gold has been pumped to a record $4,750/oz purely on trade war fear. A ruling against the tariffs removes that fear. Analysts at J.P. Morgan suggest a potential $300-$500 drop in gold prices as safe-haven money flows back into equities.

- Stock Market Relief: The S&P 500, which took a 2.1% hit yesterday, is poised for a significant rally if the "Greenland Tax" is removed from the equation.

- The Dollar Stabilizes: The "Sell America" trade slows down as international trust in the U.S. legal system is restored, preventing a further slide against the Euro.

Call to Action: Positioning for the Ruling

The Supreme Court ruling is expected within the next 48 hours. Based on the 70% probability that the Court will curb executive overreach and strike down the IEEPA tariffs, here is how the "smart money" is positioning:

- Short the Gold Bubble: Gold is currently trading at a "geopolitical premium." If the tariffs are struck down, the fear trade dissolves. Consider exiting long positions or looking at short entries as the $4,750 peak begins to look like a mountain of overextended sentiment.

- Buy the Market Dip: The recent "Greenland Slump" in the S&P 500 and tech sectors (like Nvidia and Amazon) has created a buying opportunity. If the Court rules "No," the relief rally could be the biggest of the quarter.

- Hedge with Polymarket: If you want to play the direct outcome, the "Will IEEPA be struck down?" contract is the most direct way to hedge your real-world business costs against the potential for 25% tariffs.

The clock is ticking. Whether the ice melts or the tariffs freeze, the next 48 hours will decide the winner of the Greenland Gambit.